Empowering Users Like Never Before!

Every new feature in OmniTrader 2016 is designed to help our users engage the market

and win. The biggest impact comes from Dynamic Scans.

Using a Scan, we can require that all symbols have a specific characteristic that is conducive

to a move, such as “all liquid stocks that are trending up.” Using qualified lists on the Right

Edge can definitely improve results. But to increase our confidence, we would like to know,

“What if we had ONLY traded a targeted list based on a given scan every day in the past?”

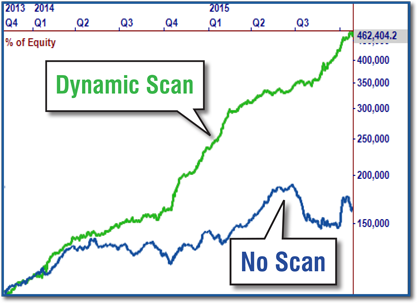

In the example below, you can see two different runs in our Portfolio Simulator on the

Reversal Strategy. One curve was produced by running the Strategy on all the stocks in

the Russell 1000. The more profitable curve was generated using a Dynamic Scan on the

same list. The difference is significant.

A Visible Difference in Trading Performance

We ran tests on identical lists in our Portfolio Simulator – one that used Dynamic Scans and one that did not.

The difference is obvious, both in terms of lower draw downs AND profits that more than doubled.

No Subscription Required!

Our Dynamic Scans feature works on any list of stocks, which can be a large index like

the Russell or even all stocks in the entire market. The symbols can come from any source

or data service.

Identifying Key Setups can make a huge difference when it comes to trading Strategy

Signals. There are many Setups that work well but, thanks to the new Dynamic Scans feature,

we found one of the biggest winners to be the Volatile Strength Scan. Volatile Strength

identifies all symbols that have greatly increased volatility. This typically means that, on that

day, the given security has either sold off or spiked up due to some fundamental event.

Often times, this Setup leads to a reversal in the opposite direction.

The Volatile Strength Scan identified an ideal Setup and the Reversal Strategy fired a long signal.

The result was a 25% gain in just two months. We ran this as a Dynamic Historical Scan on the

Russell 1000 and saw a dramatic performance improvement on our entire base OmniTrader

Strategies (see below).

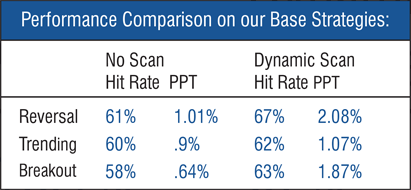

Using Dynamic Scans, OmniTrader 2016 can test every symbol in our list against this criteria

before generating Signals. We tested this Setup on ALL our base OmniTrader Strategies

(Reversal, Breakout and Trending) using Dynamic Scans.

THREE Times the Profits!

The ability to test Scans can help you determine if your Scan is finding better Setups. Here is

an experiment we ran with the new Volatile Strength Scan. The Scan results were much better

across the board, including TRIPLING the profits for the Breakout Strategy!

Now, we can understand how effective our Setups are by running tests over historical data.

And, we can do this with just one click in the ToDo List. It’s easy! This feature of the

OmniTrader 2016 upgrade will enable our users to increase profits and trade with

confidence. That’s the goal.

CLICK HERE to see more powerful features in OmniTrader 2016.